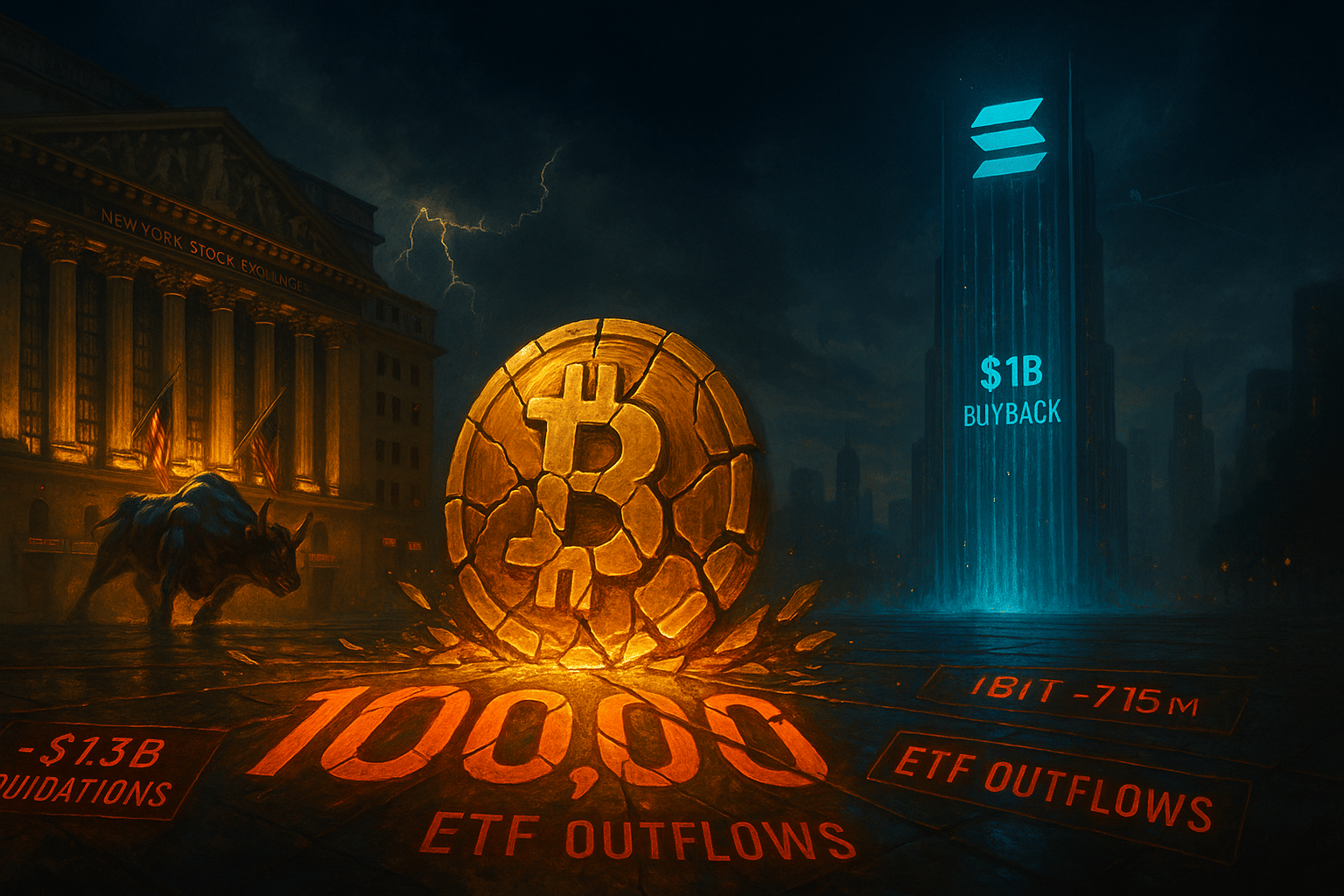

$1.3B in liquidations mark Bitcoin’s steepest fall since May, while Solana’s $1B buyback signals conviction amid chaos.

The Six-Figure Break: Bitcoin’s First Fall Below $100K Since May

The crypto market’s defining threshold finally cracked Tuesday. Bitcoin, long propped above six figures by ETF inflows and corporate treasuries, slipped below $100,000 for the first time in six months.

The move triggered $1.3 billion in liquidations and erased nearly one-fifth of Bitcoin’s October gains in a single week.

At its intraday low, Bitcoin touched $99,954 on Coinbase before rebounding modestly to $101,000. Ethereum fell nearly 10% to $3,300, Solana dropped 8% to $154, and XRP slid 7.5% to $2.17.

In a market conditioned to expect resilience, the breach below six figures reawakened old volatility habits: cascading liquidations, retreating leverage, and fear-driven repositioning.

Brian Huang of Glider called it “the aftermath of Crypto’s Black Friday,” noting a $20 billion capital shift from speculative assets into stablecoins now at record circulation highs.

From Our Partners

Institutions Are Quietly Buying This “Unsexy” Crypto

Crypto just had its biggest shakeout ever — and while most traders sold in panic, smart money was buying.

One overlooked DeFi protocol is quietly becoming Wall Street’s favorite entry point into decentralized finance.

It’s profitable, revenue-generating, and still trading at a massive discount.

History shows these quiet accumulation phases are where fortunes are made.

Find out why institutions are piling in before retail catches on.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Flow Reversal: The ETF Engine Stalls

Just weeks ago, Bitcoin’s strength rested on the gravitational pull of spot ETF demand. Now, that anchor has flipped.

BlackRock’s IBIT logged four straight days of redemptions totaling $715 million, turning steady accumulation into mechanical supply. Authorized participants redeemed shares, sold the underlying Bitcoin, and accelerated the descent.

The CME futures basis cooled to 4–5% annualized, flattening the once-profitable carry trade. Perpetual swap funding turned soft or negative, reinforcing liquidation spirals instead of cushioning them.

Analyst Liam Wright called $106,400 “the cycle’s pivot point.” Losing it, he said, transforms the rally into a distribution phase. For now, Bitcoin’s floor lies somewhere between $100,000 and $106,000 — fragile territory defined by ETF math, not emotion.

Liquidity Vacuum and Macro Pressure

Behind the technicals lies a tightening global liquidity cycle. The U.S. government shutdown pushed the Treasury General Account to $1 trillion, draining roughly $700 billion from capital markets. Repo operations hit record highs. Real yields firmed.

For Bitcoin, these forces manifest as absent bids. When ETF creations pause and macro liquidity contracts simultaneously, there’s no buffer left to absorb redemptions or miner flows. Bitcoin’s reflexive correlation to the dollar and rates has returned in full.

From Our Partners

10 Stocks for Income and Triple-Digit Potential

Why choose between growth or income when you can have both?

Our new report reveals 10 “Double Engine” stocks — companies built for rising dividends and breakout price gains.

Each has the scale, cash flow, and catalysts to outperform as markets rotate after the Fed’s pivot.

These are portfolio workhorses — reliable payouts today, compounding gains tomorrow.

Rotation and Resilience: Solana’s Contrarian Signal

While Bitcoin battles structural gravity, Solana’s ecosystem delivered a symbolic counterpunch.

Forward Industries, now the largest Solana treasury company, authorized a $1 billion share buyback program running through 2027. The move echoes Strategy’s playbook, using buybacks to reinforce balance-sheet strength tied to digital assets.

The company’s repositioning from a hardware manufacturer to a Solana treasury signals how capital is evolving: where one ledger unwinds, another consolidates.

Investor Lens

Bitcoin’s fall below $100K is less a collapse than a rotation, from mechanical inflow to capital discipline.

ETF redemptions, macro tightening, and leveraged unwinds define the moment. But signals of endurance, corporate buybacks, infrastructure pivots, and selective accumulation, suggest the ecosystem is compressing, not breaking.

Markets often test conviction before rewarding it. In crypto, that test just dropped below six figures.