Rising power costs and thin fees are squeezing miners just as Wall Street capital floods into Ripple, and traders pivot toward XRP as Bitcoin’s liquidity cycle matures.

Bitcoin’s Backbone Is Feeling the Strain

Bitcoin’s network is powered by miners, companies that run powerful computers to process transactions and secure the system.

But lately, the business of mining has become much tougher. The reward for creating new blocks has been cut in half to just over three Bitcoins per block, while electricity prices have gone up.

That means most miners are now earning barely enough to cover their energy bills. Some are shutting down older machines, while others are trying to repurpose their facilities for other uses like running AI data centers or helping power grids manage demand.

Altogether, miners are earning less than $45 million a day in total rewards, and most of that comes from the shrinking Bitcoin payout rather than transaction fees. The era when mining was a guaranteed moneymaker is over, now it’s a test of efficiency, creativity, and survival.

From Our Partners

A.I. Discipline for Volatile Markets

After years in model training, a new A.I. is giving traders measurable control when emotions take over.

Entries, exits, and risk levels are defined by math, not mood. When fear spikes or greed surges, this system stays calm, showing exactly where probability still favors your next move.

Each night, it retrains on fresh data so your edge evolves with every shift — delivering clear thinking and confidence when others are losing theirs.

Market Pulse: Capital Rotation in Motion

Broader sentiment has cooled in tandem. Bitcoin trades near $101,000, down roughly 20% from its October peak, while Ethereum sits near $3,300. Open interest across both has declined sharply as traders unwind leverage and retreat to stable positions.

BlackRock’s iShares Bitcoin ETF has seen seven consecutive days of outflows totaling more than $700 million. Across the board, ETFs tied to Bitcoin and Ethereum have lost $2.6 billion over the past week.

The move reflects a broader deleveraging phase, not just retail fear, even institutions are stepping back from risk until liquidity re-expands.

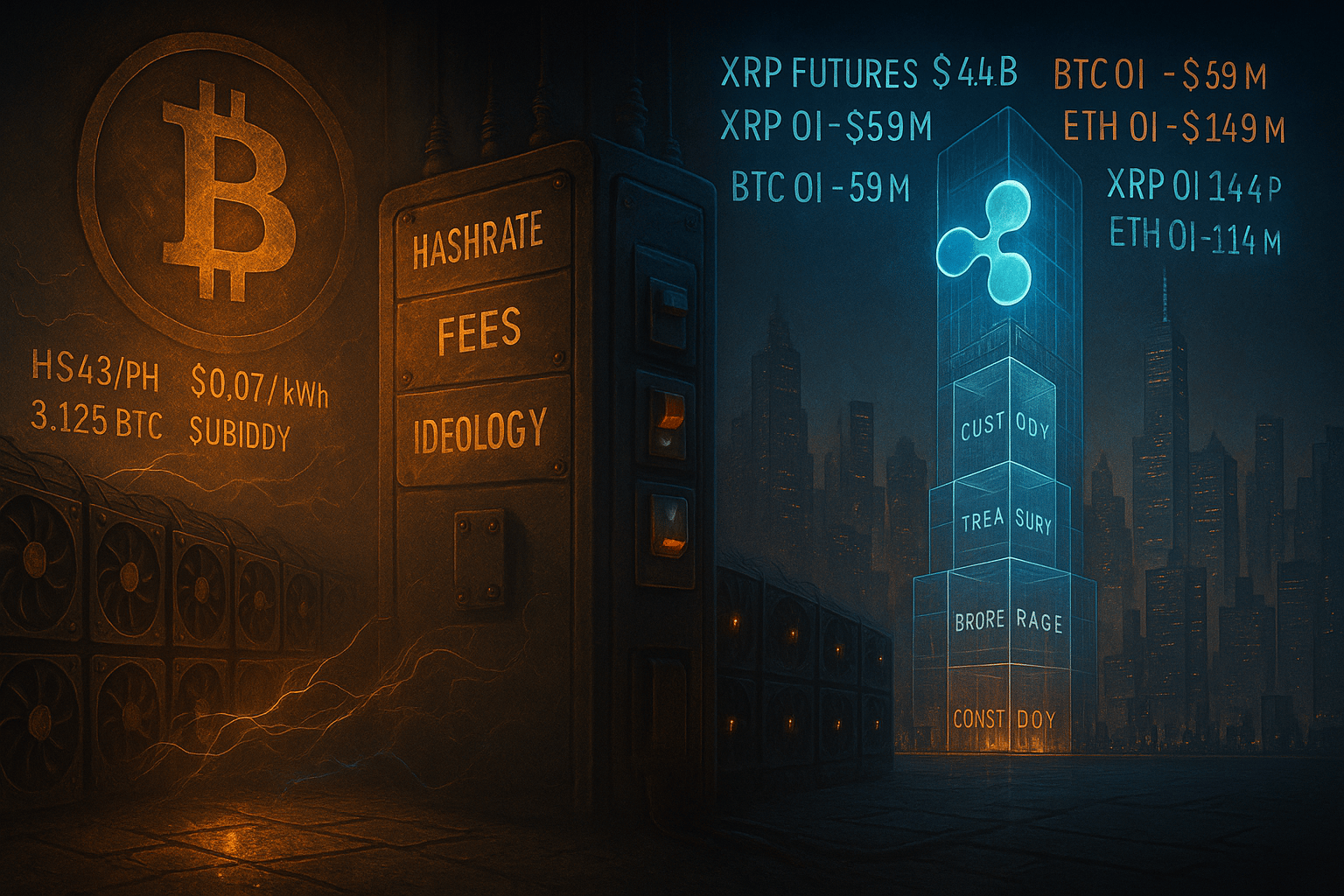

Derivatives and Flows: The Rotation into XRP

The one outlier this week is XRP. On Binance, traders are piling into the token’s futures market, where volume hit $8.4 billion compared to just $1.7 billion in spot trades.

While Bitcoin and Ethereum shed nearly $1.1 billion in open interest combined, XRP futures remain buoyant at $3.4 billion.

Traders are betting that XRP’s renewed institutional momentum, and its association with Ripple’s stablecoin infrastructure, could sustain short-term gains. The chart still shows resistance near $2.50, but market conviction is clear: while BTC and ETH holders de-risk, XRP traders are doubling down.

From Our Partners

4 Stocks Poised to Lead the Year-End Market Rally

The S&P 500 just logged its best September in 15 years — and momentum carried through October, pushing stocks to multi-month highs.

Cooling inflation, strong earnings, and rising bets on more Fed rate cuts are fueling the move.

But this rebound isn’t broad-based — it’s being driven by energy, manufacturing, and defense sectors thriving under new U.S. policy and global supply shifts.

That’s why our analysts just released a brand-new FREE report featuring 4 stocks we believe are best positioned to benefit as these trends accelerate into year-end.

Deep Signal: When Security Costs Rise

Bitcoin’s strength has always been rooted in its economic incentives. But as rewards shrink and the cost to defend the network rises, that model faces new tension.

Powering 51% of the network at current efficiency levels would draw over 10 gigawatts of electricity, an hourly burn rate that now costs hundreds of thousands of dollars.

High costs reinforce security but also reduce flexibility. If hashrate plateaus while fees stay low, the network’s security budget could stagnate even as market value grows.

Developers are pushing upgrades like one-parent-one-child relay and replace-by-fee tools to make transaction fees more reliable and predictable. The goal is simple: keep blockspace valuable enough to fund the system without relying on ideology or halving magic.

Ripple Becomes the Institutional Bridge

While miners tighten budgets, Ripple is raising them. The company’s $500 million funding round this week, backed by Citadel Securities, Brevan Howard, and Fortress, valued it at $40 billion.

Its acquisitions of Hidden Road, GTreasury, and Palisade have transformed it into a vertically integrated infrastructure firm spanning custody, treasury, and prime brokerage.

Ripple’s partnership with Mastercard, WebBank, and Gemini adds another dimension: RLUSD, its regulated stablecoin, will now settle fiat credit card transactions directly on XRPL.

The pilot marks the first collaboration between a regulated U.S. bank and a public blockchain settlement layer. For traditional finance, it’s proof that digital rails can now carry institutional weight.

From Our Partners

One Stock Poised to Soar.

After 7 bear markets, 8 bull runs, and 44 years of firsthand experience, I’ve learned what separates short-term noise from real opportunity.

Now, as Editor in Chief at WallStreetZen, I’m applying a proven 4-step system to pinpoint stocks with the potential for triple-digit gains — and one just rose to the top of my list.

This week’s “Stock of the Week” has the setup I’ve seen before every major winner I’ve ever owned: strong fundamentals, powerful catalysts, and technical confirmation.

My new pick just went live — and early positioning is key.

Investor Lens

Crypto’s new divide is not between bulls and bears, it’s between energy and efficiency. Bitcoin’s security is becoming expensive, its liquidity reactive, its cycles governed by flows. Ripple, by contrast, is becoming infrastructure, cheaper, faster, and increasingly aligned with regulated finance.

The speculative era defined by halvings and meme rallies is giving way to one defined by spreads, fees, and capital allocation. Whether miners can adapt or institutions take the mantle, the next chapter of digital finance is already being written, and this time, it’s balance sheets, not block rewards, that will decide who survives.