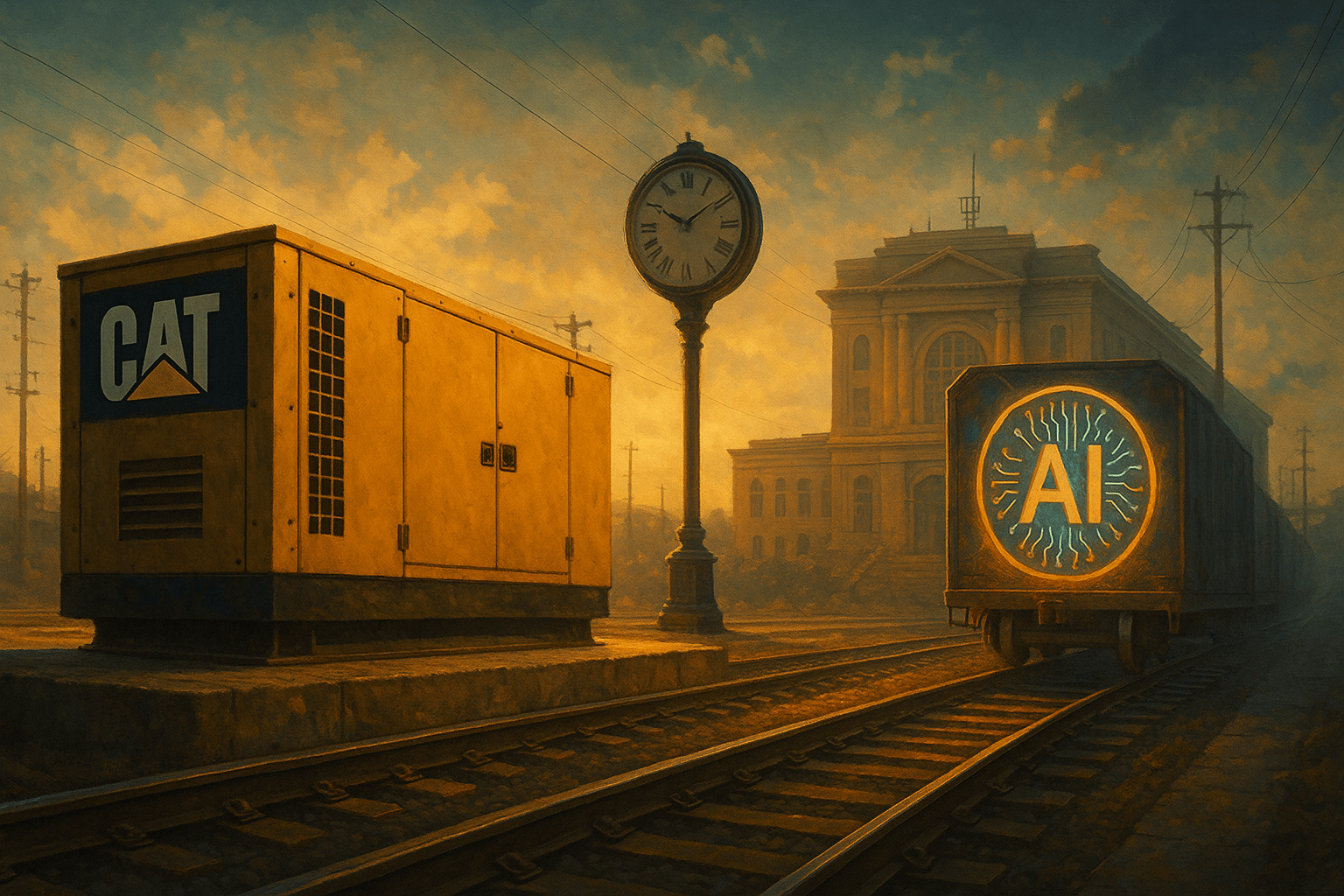

The data center boom is breathing new life into old-line industrials as AI’s energy appetite drives a surge in generator demand.

The Machines Behind the AI Boom

The next wave of AI spending is not only lifting chipmakers and cloud platforms. It is also powering up the industrial backbone that keeps those data centers alive.

Caterpillar and Cummins, two of America’s oldest heavy-machinery names, are emerging as unlikely winners. UBS estimates both could see roughly 1.5 billion dollars each in new revenue over the next few years from backup generator sales to U.S. data centers.

It is not a total reinvention of their business, but it is a clear lift. UBS analyst Steven Fisher told clients that generator revenue for both firms may nearly double off a small base as hyperscalers race to build more capacity. The core businesses remain intact – construction machinery for Caterpillar and truck engines for Cummins – but the data center wave adds a new growth tailwind.

From Our Partners

Bitcoin Just Crashed — Here’s What Happens Next

Bitcoin ETFs are scooping up 6× more coins than miners can produce — and when that imbalance snaps, prices could explode.

Those waiting for “the bottom” will miss it.

Get the Buy the Dip Blueprint — and see how elite investors turn corrections like this into life-changing gains.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Infrastructure Stocks Ride the AI Trade

Caterpillar’s stock has surged about 45 percent this year, while Cummins is up 20 percent, as investors look for exposure to AI without paying semiconductor multiples. Barclays analyst Adam Seiden believes Caterpillar could triple its annual data-center power revenue by 2030 as demand for both primary and backup generation climbs.

The setup is simple: every new AI data center needs reliable electricity, and redundancy is mandatory. Generators are the safety net. As Nvidia, Microsoft, and Amazon scale their AI operations, the demand for steady backup power is rising with them.

That demand, in turn, feeds back into the traditional economy – construction, logistics, fuel systems – and extends the AI trade into sectors that rarely see the spotlight.

From Our Partners

The 7 Stocks Built to Outlast the Market

Some stocks are built for a quarter… others for a lifetime.

Our 7 Stocks to Buy and Hold Forever report reveals companies with the strength to deliver year after year - through recessions, rate hikes, and even the next crash.

One is a tech leader with a 15% payout ratio - leaving decades of room for dividend growth.

Another is a utility that’s paid every quarter for 96 years straight.

And that’s not all - we’ve included 5 more companies that treat payouts as high priority.

These are the stocks that anchor portfolios and keep paying.

This is your chance to see all 7 names and tickers - from a consumer staples powerhouse with 20 years of outperformance to a healthcare leader with 61 years of payout hikes.

Volatility and Perspective

Despite the excitement, analysts warn against assuming a straight line upward. Generator sales still make up a small portion of total revenue for both Caterpillar and Cummins, and stocks tied to the energy-demand theme have been volatile.

Even so, Wall Street is paying attention. The UBS report frames the story not as a one-off pop but as part of a structural shift in how AI’s physical footprint ripples through the industrial economy.

The lesson is that artificial intelligence may be digital, but its growth is intensely physical. Someone has to build, power, and maintain the infrastructure that makes it real.