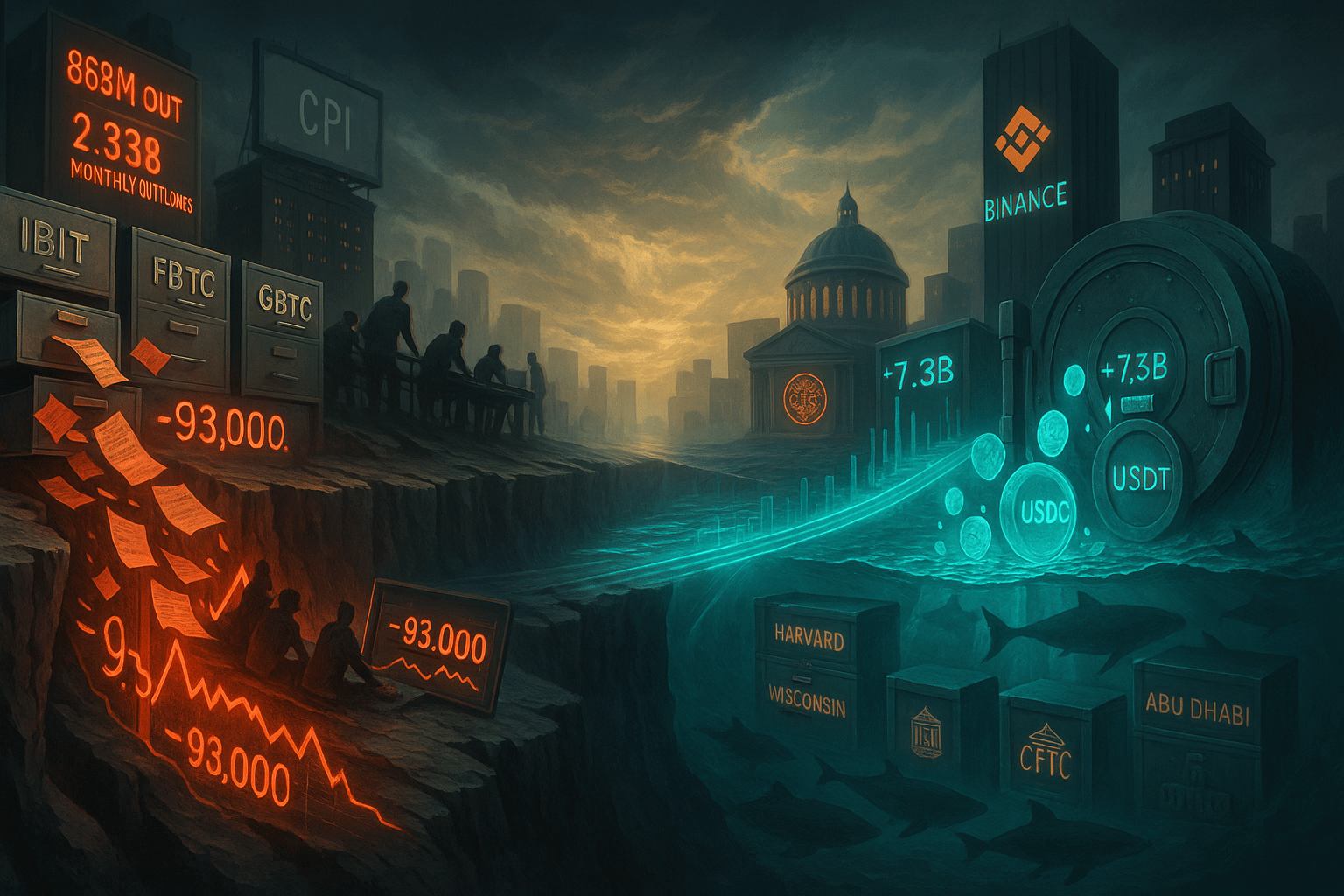

ETF outflows scream panic — but endowments, sovereign funds, and $7.3B in stablecoins tell a different story.

CRYPTO PULSE

Money Is Fleeing Bitcoin ETFs … But That’s Not Where the Real Action Is

Bitcoin ETFs just logged their second-worst month on record.

Headlines screamed panic.

Price cracked below $93,000

And U.S. spot ETFs bled nearly $870 million in a single day, putting November on track to challenge February’s all-time outflow record.

On the surface, it looked simple: institutions were heading for the exits.

But the surface is never the story.

While ETF flows turned red, Harvard tripled its Bitcoin exposure, whales quietly accumulated 36,000 BTC, and more than $7.3 billion in stablecoins moved into Binance…

.. one of the largest liquidity buildups since the 2021 cycle peak.

Someone is clearly buying what the visible market is selling.

The ETF tape told one story.

The capital underneath told another.

From Our Partners

AI's NEXT Magnificent Seven

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

DEEP SIGNAL

Harvard Just Made Bitcoin Its No. 1 Equity Position, & Did It Loudly

Here’s the part almost everyone missed.

While ETFs were bleeding billions and Bitcoin was breaking through support, Harvard University tripled its Bitcoin exposure.

The endowment’s position jumped to $442.8 million in Q3, now representing over 20% of its disclosed U.S. equity holdings, making IBIT its largest reported position.

Let that settle for a second…

One of the most conservative, methodical, reputation-guarded institutions on the planet, stewarding a $57 billion endowment, made Bitcoin its single biggest U.S. equity allocation during a correction.

Bloomberg’s Eric Balchunas called the move “as good a validation as an ETF can get,” and he’s right. Endowments of this caliber don’t chase momentum. They buy what the market misprices.

And Harvard wasn’t alone.

Wisconsin’s Investment Board holds more than 6 million IBIT shares, worth roughly $387 million.

Abu Dhabi’s sovereign wealth fund boosted its position by 230%, now owning nearly $518 million in IBIT.

These aren’t retail traders reacting to headlines.

These are slow, multi-decade allocators building exposure into weakness … precisely when most of the market is panicking.

So the real question isn’t why ETFs saw outflows.

It’s why long-horizon capital is stepping in at the very same moment.

HIDDEN FLOWS

Inside the Hidden Flows Behind Bitcoin’s Selloff

ETF outflows told one story.

Whale accumulation told another.

And the two narratives couldn’t be farther apart.

Since October 29, more than $2.6 billion has left Bitcoin and Ethereum ETFs.

Spot Bitcoin products alone saw roughly $2.5 billion in redemptions last week, marking 15 outflow days in the past 17.

That’s long-duration, compliance-driven capital stepping away from regulated wrappers … the kind of capital that moves deliberately and leaves a paper trail.

But while the visible money was heading out the front door, something very different was happening offshore.

Binance’s ERC-20 stablecoin balances surged by $7.3 billion in 30 days … a liquidity buildup not seen since just before Bitcoin’s 2024 breakout.

That’s not fear. That’s positioning.

Stablecoins are the dry powder of the crypto ecosystem. They don’t sit idle. When they pile up at that scale, it signals capital preparing to deploy … quietly, and without ETF disclosures.

And that sets up the uncomfortable truth:

The institutions redeeming ETFs are not the same institutions accumulating Bitcoin.

Two playbooks. Two timelines. Two completely different intentions.

From Our Partners

The DeFi Play Wall Street Is Quietly Loading Up On

The flash crash cleared the weak hands — and now the real opportunity begins.

While retail chases hype, institutional money is quietly accumulating one DeFi protocol dominating its sector. It generates real revenue, massive volume, and consistent value for holders — exactly what Wall Street wants.

Trading at a steep discount, this “boring” altcoin could be Q4’s breakout.

INSTITUTIONS & CRYPTO

The Great Rotation Wall Street Isn’t Pricing In

Here’s the part most analysts won’t say out loud: ETF outflows aren’t bearish … they’re rotational.

They’re the migration of capital from retail-facing wrappers into the kind of infrastructure the public can’t see yet.

During the government shutdown, allocation committees were forced to de-risk.

Nearly $15 billion per week evaporated from the economy, rate-cut odds collapsed, and risk desks tightened exposure across every volatile asset class.

That explains the visible exits … the redemptions, the selling pressure, the uptick in ETF outflow headlines.

But the shutdown ended.

Liquidity is returning.

Look at the pattern:

What left:

Short-horizon institutional money … risk committees managing drawdowns, funds locking in post-election profits, allocators trimming exposure into macro uncertainty.

What arrived:

Endowments with decade-long mandates, sovereign wealth funds building strategic exposure, and offshore capital positioning through massive stablecoin inflows.

Two entirely different investor classes.

Two entirely different motivations.

And two completely different time horizons.

ETF flows represent the visible money … slow, regulated, compliance-heavy capital that discloses its every move.

Stablecoin accumulation represents the invisible money … faster, strategic, and unreported in 13Fs.

Both are institutional.

They’re just operating on different rails.

And once you see the divergence, the entire narrative around Bitcoin’s selloff shifts.

CRYPTO INFRASTRUCTURE

When The Infrastructure Arrives, The Money Follows

ETF redemptions stole the headlines.

But the real story was unfolding elsewhere.

The Commodity Futures Trading Commission quietly signaled that it’s preparing to authorize leveraged spot crypto trading on regulated U.S. exchanges … potentially within weeks.

This isn’t a technical footnote. It’s the missing infrastructure institutions have been waiting for.

For years, serious traders who needed leverage had only two choices:

go offshore and swallow counterparty risk, or

limit exposure to cash products and CME futures, which capped strategy flexibility.

That fragmentation kept billions of dollars of professional capital either sidelined or half-engaged.

This changes that.

Imagine a multi-strategy fund running delta-neutral trades, basis spreads, liquidity rotations, and volatility arbitrage … all with the same regulatory clarity they have in equities or FX.

That’s when the real institutional machinery switches on.

And it reframes the ETF outflow story entirely.

Why pay management fees for a spot ETF when, in a matter of weeks, you may be able to run levered, hedged, capital-efficient exposure onshore?

The ETF redemptions might not be exits at all.

They may be capital standing on the sideline, waiting for better tools.

And those tools are almost here.

ON-CHAIN INTELLIGENCE

The Accumulation Pattern Hiding In Plain Sight

On-chain data told a completely different story than the price tape.

Over the past week, Binance saw nearly $1.8 billion in Bitcoin and Ethereum flow off the exchange … while at the same time recording roughly $1.6 billion in stablecoin inflows.

That’s not panic. That’s accumulation mechanics.

This two-sided movement … coins out, liquidity in … has historically preceded several major recoveries.

And it fits the behavioral split unfolding right now:

Short-term holders sold into fear.

Long-term holders absorbed that supply with capital they had already staged.

If you look closely, ETF outflows are likely the visible selling leg of the trade…

while stablecoin inflows represent the invisible buying leg.

One shows up in public filings.

The other never does.

Together, they form the same pattern we’ve seen before every major upside inflection.

From Our Partners

Apple’s Starlink Update Sparks Huge Earning Opportunity

Mode’s EarnPhone hit 50M+ users even before global satellite coverage.

With SpaceX eliminating "dead zones", Mode's earning technology can now reach billions more, putting them a step closer to potential IPO.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

MACRO READ

The Macro Story Retail Keeps Misreading

Bitcoin sliding below $93,000 … erasing every gain of 2025 … looked like classic capitulation.

A 27% drawdown from the October highs, ETF outflows piling up, headlines screaming “institutional exit.”

But the flows underneath tell a completely different story.

Harvard doesn’t triple a position into a dying asset.

Sovereign wealth funds don’t boost exposure by 230% into a bear market.

And $7.3 billion doesn’t move into Binance stablecoin reserves ahead of “further downside.”

The pattern is clear: Institutions aren’t exiting. They’re building … just not where retail can see them.

The government shutdown spooked risk committees.

Compliance desks trimmed exposure.

ETF wrappers … the most transparent vehicles in the market … showed the selling first because they must.

That’s only the visible side of the trade.

Offshore, behind the headlines, the longer-horizon capital stepped in:

Endowments with decade-long mandates increased exposure.

Sovereign wealth funds accumulated at scale.

Stablecoin liquidity surged to levels not seen since late 2024 — right before Bitcoin broke its previous ATH.

That divergence matters for allocators.

If you’re trading short-term price action, this month looked catastrophic.

If you’re managing multi-year institutional capital, it looked like positioning.

The $2.3 billion in ETF outflows reflects tactical de-risking … macro uncertainty, shutdown pressure, profit-taking after Q3’s rally.

That’s not abandonment; it’s prudent risk management.

Meanwhile, the structural story is being written somewhere else entirely.

The CFTC preparing to authorize leveraged spot trading…

Japan reforming crypto custody…

The U.K. approving new settlement frameworks…

These aren’t headlines, they’re foundations.

They’re the infrastructure upgrades that turn crypto from a speculative asset into a permanent allocation.

And the irony is this:

The institutions redeeming ETFs today may be the same ones preparing to re-enter through better tools tomorrow … prime brokers, OTC desks, and new regulated vehicles built for real size.

Retail sees a selloff.

Institutional allocators see preparation.

Two timelines. One story:

This isn’t outflow capitulation, it’s rotation.

CLOSING LENS

What The Tape Won’t Tell You

Bitcoin sits below every major moving average … 18-day, 50-day, 100-day, 200-day.

The technical damage is real. Short-term volatility is almost guaranteed.

But the tape rarely tells the full story.

The shutdown is over.

Liquidity is coming back online. And $7.3 billion in stablecoins is still parked on Binance … untouched, waiting.

Another week of ETF outflows would look ugly on paper.

But if it comes alongside continued stablecoin buildup, tighter spreads, and cooling volatility, it won’t be a sign of exit … it’ll be a sign of rotation.

That’s the part the charts won’t show you.

Harvard doesn’t triple a position because it sees a dying asset.

Abu Dhabi doesn’t build a half-billion-dollar stake because it expects deeper lows.

These allocators aren’t questioning Bitcoin’s place … they’re questioning the wrappers.

This month’s message from the smartest money in the room wasn’t “we’re out.”

It was: “We’ll wait for the right rails.”

And patience isn’t bearish.

Patience is positioning.