Higher rates, tighter liquidity, AI capex, tariffs, and discipline shaped every asset class. Crypto was no exception.

The Market Crypto Had to Trade Inside

2025 was not a year of collapse.

It was a year of constraint.

Markets did not break.

They tightened.

Interest rates stayed higher than most investors expected. Liquidity never became abundant. Cash paid real yield, not theoretical yield, and that single fact quietly rewired behavior across every asset class.

This was not a market that rewarded imagination.

It rewarded proof.

Equities held up, but leadership narrowed. Credit stayed open, but terms hardened.

Commodities moved on supply and geopolitics, not optimism. Capital concentrated rather than expanded.

Crypto did not escape this environment.

It lived inside it.

That is the most important thing to understand about the year.

From Our Partners

10 AI Stocks to Lead the Next Decade

AI is fueling the Fourth Industrial Revolution and these 10 stocks are front and center.

Another leads warehouse automation, with a $23B backlog, including all 47 distribution centers of a top U.S. retailer, plus a JV to lease robots to mid-market operators.

From core infrastructure to automation leaders, these companies and other leaders are all in The 10 Best AI Stocks to Own in 2026.

Free today, grab it before the paywall locks.

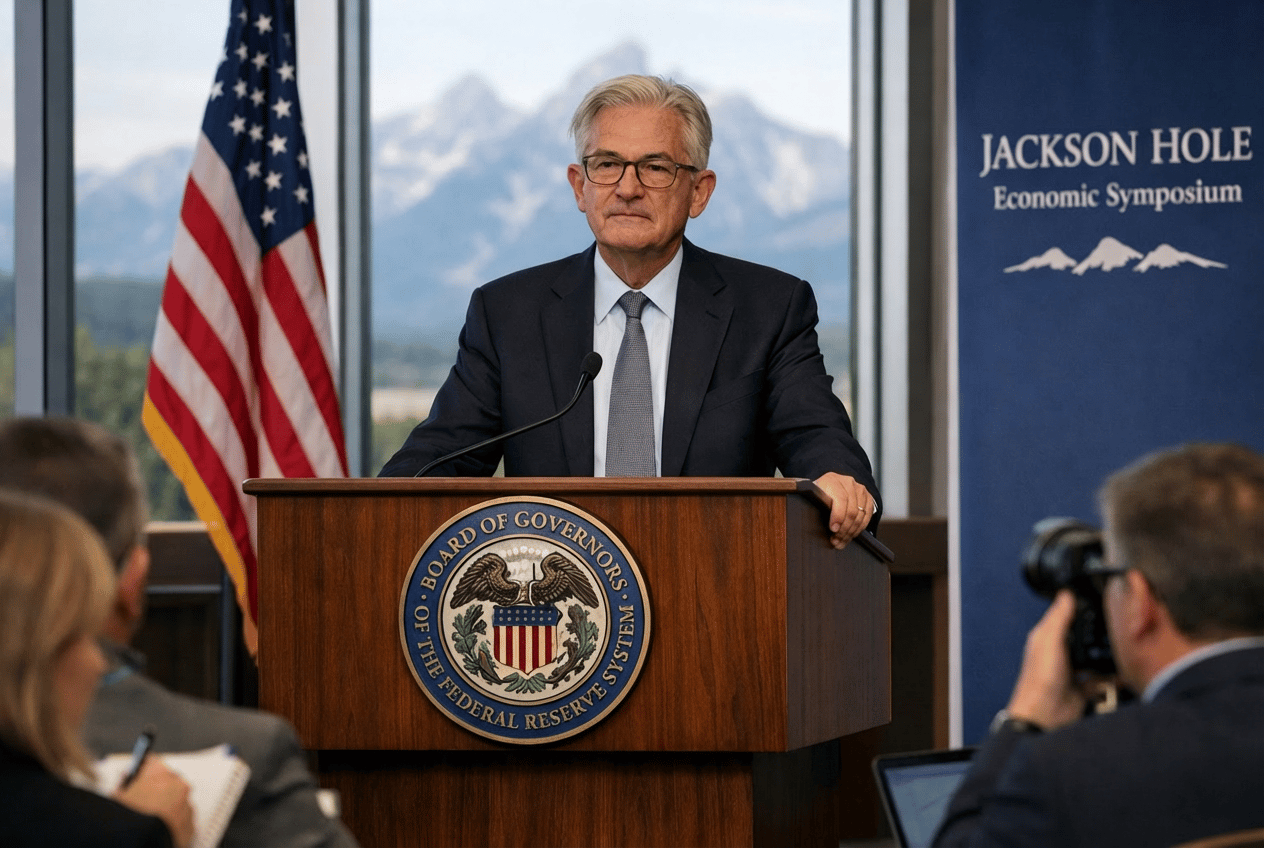

The Macro Regime: Why Speculation Never Fully Returned

The year began with expectations of easing.

It ended with restraint intact.

The Federal Reserve held its line longer than markets wanted. Inflation cooled, but not cleanly enough to justify aggressive cuts. Policy stayed restrictive. Financial conditions never loosened enough to support broad speculative excess.

At the same time, trade friction returned as a structural feature rather than a headline risk.

Tariffs, supply chain reshoring, and geopolitical fragmentation raised costs and uncertainty across global markets. Companies responded by prioritizing resilience over reach.

Capital spending surged, but only in one direction.

AI and data centers.

Compute, power generation, cooling infrastructure, and grid reinforcement absorbed enormous amounts of capital.

That wave mattered. It pulled investment toward scale, durability, and balance sheets that could support long-cycle spending. It crowded out weaker speculative opportunities elsewhere.

Energy became a limiter again.

Not a crisis.

A constraint.

This was not an environment that punished risk entirely.

It punished undisciplined risk.

This was the market crypto had to trade inside.

How Capital Behaved Across Financial Markets

Equity markets made the message clear.

Scale mattered. Margins mattered. Balance sheets mattered.

Companies that could self-fund growth and absorb friction held premiums. Those that relied on cheap capital or optimistic assumptions struggled to sustain attention.

Credit markets confirmed the same dynamic. Defaults remained contained, but underwriting tightened.

Capital was available, but it was not forgiving. Weak structures were filtered out quietly rather than explosively.

Commodities reflected realism rather than growth enthusiasm. Moves were driven by supply constraints, geopolitics, and policy risk. Scarcity mattered more than demand acceleration.

Across markets, one pattern dominated.

Capital became selective.

Then it concentrated.

Crypto followed that pattern, not because it lost relevance, but because it stopped being treated as exceptional.

From Our Partners

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

Crypto Stops Acting Like an Exception

In prior cycles, crypto often behaved as if it were exempt from macro forces.

It moved early. It moved faster. It absorbed liquidity before traditional markets reacted.

That exceptionalism faded in 2025.

Crypto increasingly traded like a high-volatility expression of global risk appetite.

When financial conditions loosened, crypto rallied. When uncertainty increased, participation thinned. When liquidity rotated, crypto rotated with it.

Rallies still happened.

Follow-through was harder to earn.

Broad participation never fully returned. Optionality stopped getting paid. The market demanded confirmation rather than belief.

This was not crypto failing.

It was crypto aligning.

For the first time in years, crypto’s behavior made sense to investors who primarily watch rates, equities, and commodities.

Infrastructure Lessons, Not Crypto Lessons

One of the clearest parallels of the year came from how markets treated infrastructure.

In traditional finance, infrastructure did not trade like growth simply because usage increased.

Payment networks, utilities, logistics platforms, and clearing systems were valued for reliability, not excitement.

Crypto experienced the same repricing.

Activity held up. Usage persisted. But value accrual was questioned. The market began separating systems that enable activity from assets that capture it.

That distinction mattered.

Growth without structure lost favor everywhere in 2025. Crypto was not immune to that discipline, nor should it have been.

Bitcoin Benefits From Simplicity

Against this backdrop, Bitcoin benefited from clarity.

In a market defined by constraint, simplicity became an advantage. Bitcoin was easy to explain, easy to frame, and easy to position alongside other macro assets.

Institutional flows reflected that preference. ETF participation remained steady rather than euphoric.

Bitcoin increasingly behaved like a volatile alternative allocation rather than a speculative outlier.

It did not replace gold.

It did not replace equities.

It occupied a lane.

And in a year where capital was disciplined, defined lanes mattered.

From Our Partners

You Missed the Crypto Bottom — This Is the Do-Over

Let’s be real.

Most investors froze at the bottom. Fear won. That window is gone.

But the recovery just opened a second chance — and in some ways, it’s even better. This time, there’s confirmation.

The crash wiped out hype and exposed which cryptos actually matter. What survived? Fundamentals.

One crypto is flashing the same setup we saw before massive runs:

8,600% (OCEAN)

3,500% (PRE)

1,743% (ALBT)

Strong on-chain data. Growing network. Active development.

Yet the price still hasn’t caught up.

That gap won’t stay open for long.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Institutions Act Like Institutions

Institutional engagement with crypto continued, but without illusion.

Allocations were measured. Exposure was controlled. Infrastructure improved. Leverage stayed limited. There was no rush to transform portfolios and no urgency to believe.

Crypto was treated the same way institutions treated other volatile assets.

Proportionately.

That consistency mattered more than enthusiasm. It signaled normalization rather than neglect.

Crypto no longer required faith.

It required discipline.

And discipline is how asset classes survive restrictive environments.

Regulation Becomes a Background Condition

Regulation did not arrive as a shock.

It accumulated.

Rules clarified slowly. Enforcement remained uneven. Markets adjusted anyway.

Structures dependent on ambiguity lost momentum. Those built to operate within constraint gained durability.

Crypto did not become frictionless.

It became legible.

That legibility reduced upside excitement, but it increased survivability.

In 2025, survivability mattered.

From Our Partners

The New #1 Stock in the World?

A tiny company now holds 250 patents tied to what some call the most important tech breakthrough since the silicon chip in 1958.

Using this technology, it just set a new world speed record — pushing the limits of next-generation electronics.

Nvidia has already partnered with this firm to bring its tech into advanced AI systems.

This little-known company could soon become impossible to ignore.

What the Year Actually Settled

2025 did not decide whether crypto would replace the financial system.

It answered a more grounded question.

How does crypto behave when it must compete for capital inside a disciplined market defined by higher rates, selective liquidity, geopolitical friction, and real alternatives?

The answer was clear.

Crypto rises when liquidity allows risk.

It stalls when the system demands restraint.

It rewards structure.

It punishes excess.

Just like everything else.

Crypto enters the new year stripped of exaggeration but supported by reality. Smaller than its boldest promises. More durable than its harshest critics expected.

It now behaves like an asset class that intends to survive.

CryptoHiiv will continue watching crypto where it actually lives.

Inside global markets.

Not above them.