Markets pause ahead of the Fed, but payments, rails, and institutional posture keep advancing beneath flat prices.

CRYPTO PULSE

What Changed Since The Open

This afternoon isn’t about a turn.

It’s about separation.

Equities pushed to new highs.

The dollar slid harder.

Bitcoin barely moved.

That mix matters.

Policy shock hit health insurers and stayed contained.

Tech absorbed attention and kept the index level bid.

Meanwhile, the dollar weakened again after White House comments, quietly reopening the credibility channel without triggering broad risk-off behavior.

Crypto is reading that correctly.

Bitcoin is not responding to the equity signal.

It is responding to the currency signal.

When FX drives the day, crypto trades like inventory, not like narrative.

That’s exactly what we saw. No panic. No chase. Just steady holding as capital waits to see whether dollar softness turns into disorder or stabilizes as talk.

Metals cooling after extreme moves adds to that pause. Gold didn’t collapse. Silver gave back excess. That relieves pressure without handing crypto a clean baton yet.

This is not rejection.

It’s sequencing.

Institutions are still engaging, but selectively. Flows are tighter. Conviction is deferred. Price stays pinned because no one is being forced to move first.

If FX keeps sliding in an orderly way, crypto gets room.

If credibility stress escalates, it stays boxed.

This afternoon is not about momentum.

It’s about restraint doing its job.

Premier Feature

Why This Trader Stopped Watching the Market All Day

Most traders think success means staring at charts for hours.

But one veteran trader discovered a short daily window where the market consistently reveals its best setups often in under 20 minutes.

After that, he steps away.

No chasing moves. No emotional decisions.

He’s now breaking down this simple approach in a free online web class that’s drawing thousands of traders right now.

Access is only open for a limited time.

MARKET STATE

Flat Tape, Active Plumbing

This afternoon is not about price discovery.

It’s about where motion is still happening.

That flatness is not stagnation.

It’s a pause while infrastructure continues to reorganize underneath.

Payments rails are scaling.

Stablecoin frameworks are tightening.

Institutions are refining exposure rather than walking away.

Price feels inert because speculation has stepped back.

Usage has not.

This is not a market losing relevance.

It is a market narrowing focus.

CAPITAL FLOWS

Why the Exit Still Matters

The more revealing signal remains what’s leaving, not what’s rotating.

Stablecoin balances continue to trend lower, telling us capital is choosing distance over proximity. This is not fear-driven liquidation. It’s deliberate disengagement.

In past cycles, capital stayed parked inside the system, waiting for re-entry.

This time, it’s opting out entirely.

That choice dampens reflexive rallies.

It also raises the bar for upside.

Without idle capital waiting nearby, moves require conviction, not momentum.

MARKET STRUCTURE

Fragmentation Without Failure

Price gaps across venues persist.

Not because arbitrage is broken — but because it’s selective.

U.S. rails are absorbing ETF pressure faster than offshore leverage can unwind.

Banking friction, compliance latency, and balance-sheet caution slow the closing of spreads.

Markets still function.

They just don’t snap back.

This is what stress looks like in plumbing before it shows up in headlines.

From Our Partners

New Gold Price Target: January 28 Warning

Major investment banks now predict gold could surge past $6,000 an ounce this year — with some analysts even calling for $10,000.

With 2026 shaping up to be a year of growing uncertainty, many expect gold to skyrocket.

But before you rush to buy bullion or gold stocks, there’s something important to know.

Most investors will likely miss the biggest gains because there’s a little-known way to profit from gold that has nothing to do with bullion, ETFs, or mining stocks. In one period alone, this approach reportedly turned $5,000 into more than $1.6 million.

VOLATILITY

Comfort With Turbulence, Not Direction

Volatility is being priced.

Trajectory is not.

Participants are increasingly comfortable expressing uncertainty without committing to a view. Directional bets remain scarce. Hedging remains active.

This is restraint, not anxiety.

Markets are admitting they don’t know what comes next — and are content waiting for macro to answer first.

INSTITUTIONAL SIGNAL

Who Is Still Leaning In

The marginal buyer is no longer chasing upside.

It’s institutionalizing exposure.

Treasury-style accumulation, long-duration balance sheets, and language shifts from policymakers matter more than daily price action. These are not timing decisions. They are positioning decisions.

That changes the texture of the market.

Less capitulation.

Less euphoria.

More patience.

REGULATION AND RAILS

Clarity Is Slower, Usage Is Faster

Legislative clarity continues to lag.

Operational usage does not.

This creates a split market:

Slow headlines.

Fast implementation.

Crypto is being built into systems even as price waits for permission.

From Our Partners

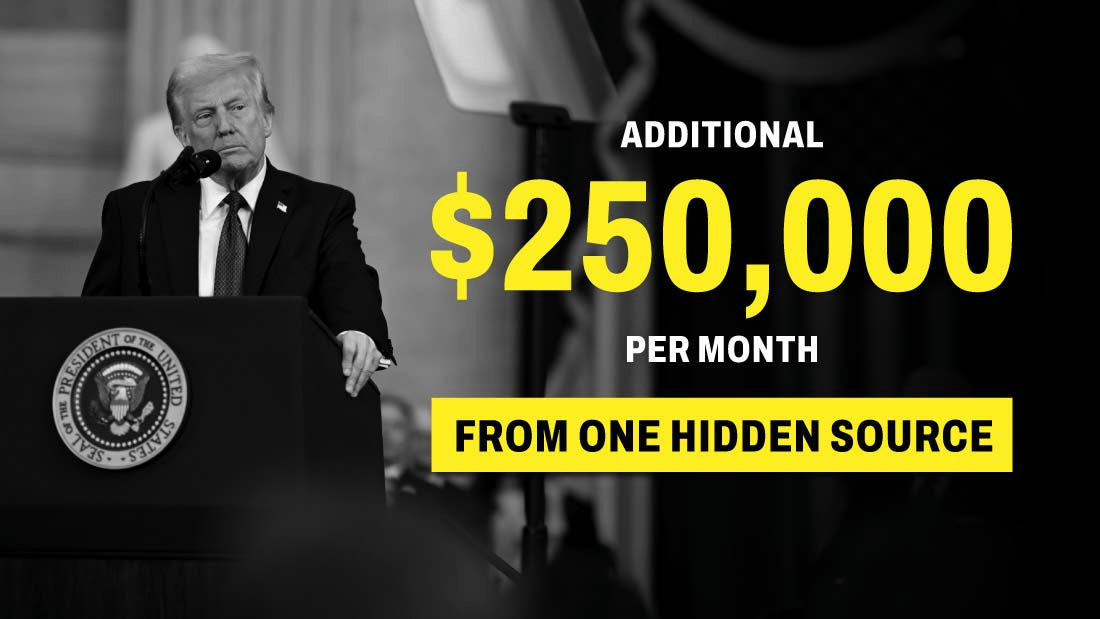

Trump's $250,000/Month Secret Exposed

While President Trump's official salary is $400,000 per year... his tax returns reveal he's been collecting up to $250,000 PER MONTH from one hidden source.

Until recently, most Americans couldn't touch the type of investment that makes up this investment. But thanks to Executive Order 14330, that just changed.

If you love investing in disruptive new companies... Discover how to invest in the fund Trump uses to collect this income >>

PAYMENTS

Where Momentum Is Quietly Concentrating

The most consistent adoption signal is boring on purpose.

Infrastructure that abstracts complexity is winning.

Not loudly.

But persistently.

This is crypto becoming useful rather than impressive.

GLOBAL CONTEXT

Trade Tension Is Now Structural

Market access, digital regulation, and platform treatment are now bargaining tools, not policy footnotes. That raises the premium on neutral, portable rails that don’t rely on diplomatic goodwill.

Jurisdictional resilience is becoming a feature, not a bonus.

SEQUENCING

Why This Still Feels Slow

This market is not asking if crypto matters.

It’s asking when it gets to lead again.

First, FX needs to calm.

Then rates.

Then equities digest earnings without compression.

Crypto moves last in this sequence.

That’s not weakness.

It’s order.

WHAT TO WATCH INTO THE CLOSE

Three signals still matter most:

Stabilization in stablecoin supply.

Compression across venue spreads.

Calm follow-through in FX after macro events.

None require bullish headlines.

They require mechanical improvement.

CLOSING LENS

This afternoon is not about excitement.

It’s about alignment.

Infrastructure is advancing faster than price.

Institutions are refining exposure, not abandoning it.

Usage is compounding quietly.

Crypto isn’t stalled.

It’s waiting for the system to finish repricing trust.

When that clears, positioning is light, expectations are low, and optionality is high.

That’s not a bad place to be.