Rotation replaced retreat as risk stayed conditional.

CRYPTO PULSE

How to Read the Market This Afternoon

This afternoon wasn’t about extending strength.

It was about proving durability.

Equities didn’t retreat, they redistributed. Capital moved out of crowded tech exposure and into areas with visible funding, cash flow, and political backing. Defense and energy absorbed flows.

Cyclicals stabilized. Growth wasn’t abandoned. It was screened. That distinction matters because it tells you risk appetite hasn’t disappeared, it has conditions.

Oil echoed the same message. Despite continued focus on Venezuela and U.S. control over supply routing, crude refused to carry urgency. Prices lifted, then settled.

No fear premium emerged. When geopolitics gets processed through contracts and governance instead of shocks, oil stops transmitting volatility across assets.

Rates stayed central. Treasury yields firmed modestly as positioning built ahead of tomorrow’s jobs data.

This wasn’t tightening pressure. It was calibration. Markets aren’t pricing error, they’re waiting for validation. Until that arrives, acceleration stays capped.

Crypto traded squarely inside that framework. Bitcoin drifting toward the low $90Ks didn’t produce disorder. Volatility stayed contained.

Liquidity remained intact. Price action reflected patience, not stress. That’s what digestion looks like when positioning adjusts without leverage breaking.

This market isn’t asking what can move fastest.

It’s asking what can stay functional while inputs resolve.

As long as oil continues to absorb geopolitics without shock and rates remain data-dependent rather than reactive, crypto remains tethered to macro discipline, not narrative impulse.

The next directional move won’t come from another headline. It will come when confirmation finally clears.

Premier Feature

The $300 Crypto Smart Money Is Targeting for January

This isn’t a hype-driven flyer.

It’s a DeFi protocol trading near $300 that our research suggests could have a realistic path toward $3,000+, based on fundamentals institutions care about.

Real, growing revenue

$60+ billion in total value locked

Institutional adoption accelerating

Token supply shrinking through buybacks

With new regulations opening the door for institutional capital, trillions in managed assets can now access this protocol. That’s why we believe this could be the #1 crypto to own heading into January.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

CAPITAL FLOW TELL

When Adjustment Replaces Acceleration

The defining feature of today’s flows wasn’t exit.

It was moderation.

Capital continued to rebalance rather than retreat. ETF activity across crypto reflected portfolio-level decisions instead of sentiment breaks.

Bitcoin-linked products saw positioning ease as investors reduced early-year exposure without abandoning the asset class.

That pattern matters.

It tells you demand is still present, but it is no longer reflexive.

This is what institutionalization looks like in practice. Capital no longer chases uninterrupted momentum. It trims, reallocates, and waits. Flows are becoming granular, issuer-specific, and sensitive to timing rather than narrative strength.

This isn’t risk leaving the system.

It’s risk being priced more carefully.

MACRO CONTEXT

Why Policy Signals Matter More Than Direction

Macro remains the gating factor.

The most aggressive headline today came from the Fed’s dovish edge, with public commentary floating up to 150 basis points of potential easing. Markets heard the number, but discounted the messenger.

Still, the signal matters. Not as a forecast, but as a boundary.

The debate has moved from whether cuts are needed to how quickly they could arrive. That keeps risk assets supported, but capped.

Trade data reinforced the same ambiguity. The sharp contraction in the U.S. trade deficit reads positive on the surface, but the internals tell a different story.

Gold flows, tariff anticipation, and inventory behavior are driving the headline, not a resurgence in underlying demand.

Macro inputs look constructive.

But they are not yet decisive.

From Our Partners

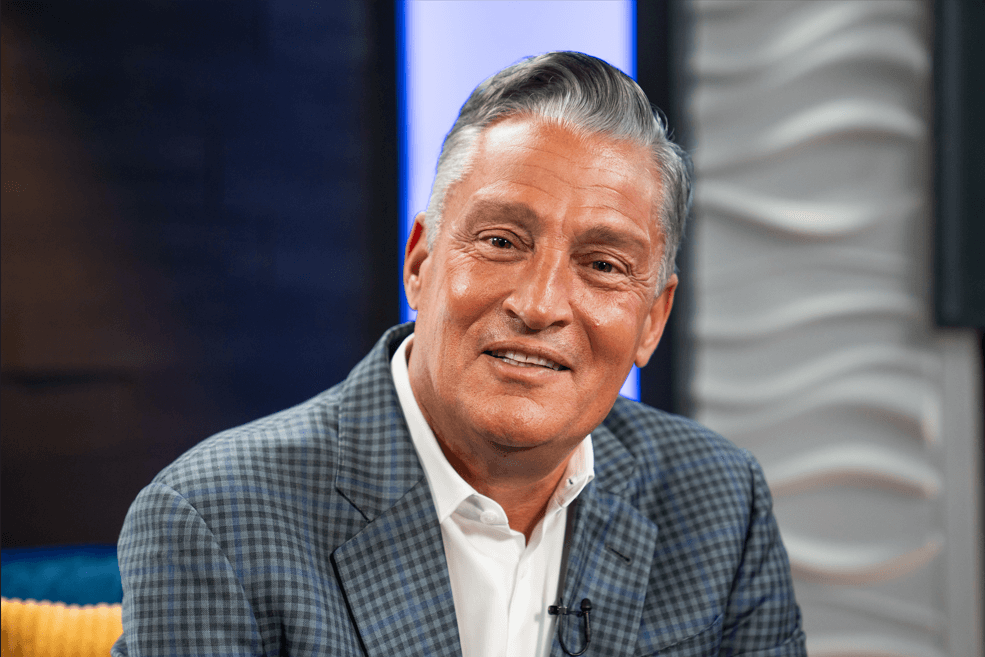

Trump's $250,000/Month Secret Exposed

While President Trump's official salary is $400,000 per year... his tax returns reveal he's been collecting up to $250,000 PER MONTH from one hidden source.

Until recently, most Americans couldn't touch the type of investment that makes up this investment. But thanks to Executive Order 14330, that just changed.

If you love investing in disruptive new companies... Discover how to invest in the fund Trump uses to collect this income >>

CREDIT & YIELD

Normalization Becomes the Story

Rates continue to do the real work beneath the surface.

Treasury yields firmed modestly as positioning adjusted ahead of upcoming labor data. This wasn’t tightening pressure. It was normalization.

Markets are learning to operate without constant liquidity expansion, and without panic.

Productivity data underscored the shift. Output is rising faster than labor input, compressing unit labor costs and easing inflation pressure without igniting hiring.

That supports the case for eventual easing, but it also removes urgency.

Credit isn’t flashing stress.

It’s signaling restraint.

For crypto, that environment is supportive, but only conditionally. Liquidity expectations help hold the floor. They don’t justify acceleration.

STABLECOINS & POLICY

Governance Moves to the Foreground

Stablecoins are no longer being judged on innovation.

They’re being judged on control.

Legislative momentum around crypto now hinges less on technical design and more on political tradeoffs, particularly around yield, custody, and conflicts of interest.

At the same time, enforcement-heavy regimes like India continue to emphasize restriction without offering credible onshore frameworks.

The result is familiar: activity doesn’t disappear. It reroutes.

Meanwhile, credit yields across crypto are compressing. That isn’t fading demand, it’s maturation. Vanilla yield is becoming infrastructure, not alpha.

The stablecoin debate has shifted.

From incentives to legitimacy.

MARKET STRUCTURE

Infrastructure Ships While Price Pauses

The most durable signal today didn’t come from price.

It came from buildout.

At the same time, broader industry signals, from Moody’s to major exchanges, point in the same direction.

Digital assets are being evaluated as settlement layers, liquidity tools, and capital infrastructure rather than speculative vehicles.

This is how maturation shows up.

Quietly. Incrementally. Under scrutiny.

Markets rarely reward this immediately.

They price it once it proves durable.

From Our Partners

STOP! Don't buy any more Bitcoin

According to former hedge fund manager Larry Benedict, there's an unusual way to play the Bitcoin markets…

And you don't have to invest a dime in Bitcoin!

You could receive regular profits of up to $4,898 or more…

All without the risk, uncertainty, or stress of actually buying Bitcoin.

GEOPOLITICS

Managed, Not Repriced

Geopolitical risk stayed present, but contained.

Tariff uncertainty moved closer to a legal inflection, yet markets treated it as procedural rather than existential.

The assumption isn’t that tariffs disappear. It’s that they reappear through different mechanisms.

Oil told the same story. Venezuela remains central to the narrative, but supply developments continue to be treated as routing decisions, not shocks. Prices adjusted, then stabilized.

When geopolitics becomes administrative, not disruptive, volatility struggles to propagate.

That was the tone today.

Managed. Not repriced.

INVESTOR SIGNAL

This is a market transitioning from expansion to evaluation.

Capital is no longer asking which assets promise upside.

It’s asking which systems remain functional under constraint.

Crypto demand hasn’t vanished. It has matured. Flows are measured. Allocation is deliberate. Infrastructure is advancing faster than price.

That combination doesn’t produce fireworks.

It produces endurance.

CLOSING LENS

This afternoon wasn’t about momentum.

It was about confirmation.

Markets absorbed policy noise, legal risk, and sector rotation without breaking posture. That’s not complacency. It’s calibration.

Crypto isn’t being rejected.

It’s being held to a higher standard.

In this phase, patience matters more than conviction.

Acceleration comes later.

First comes proof.