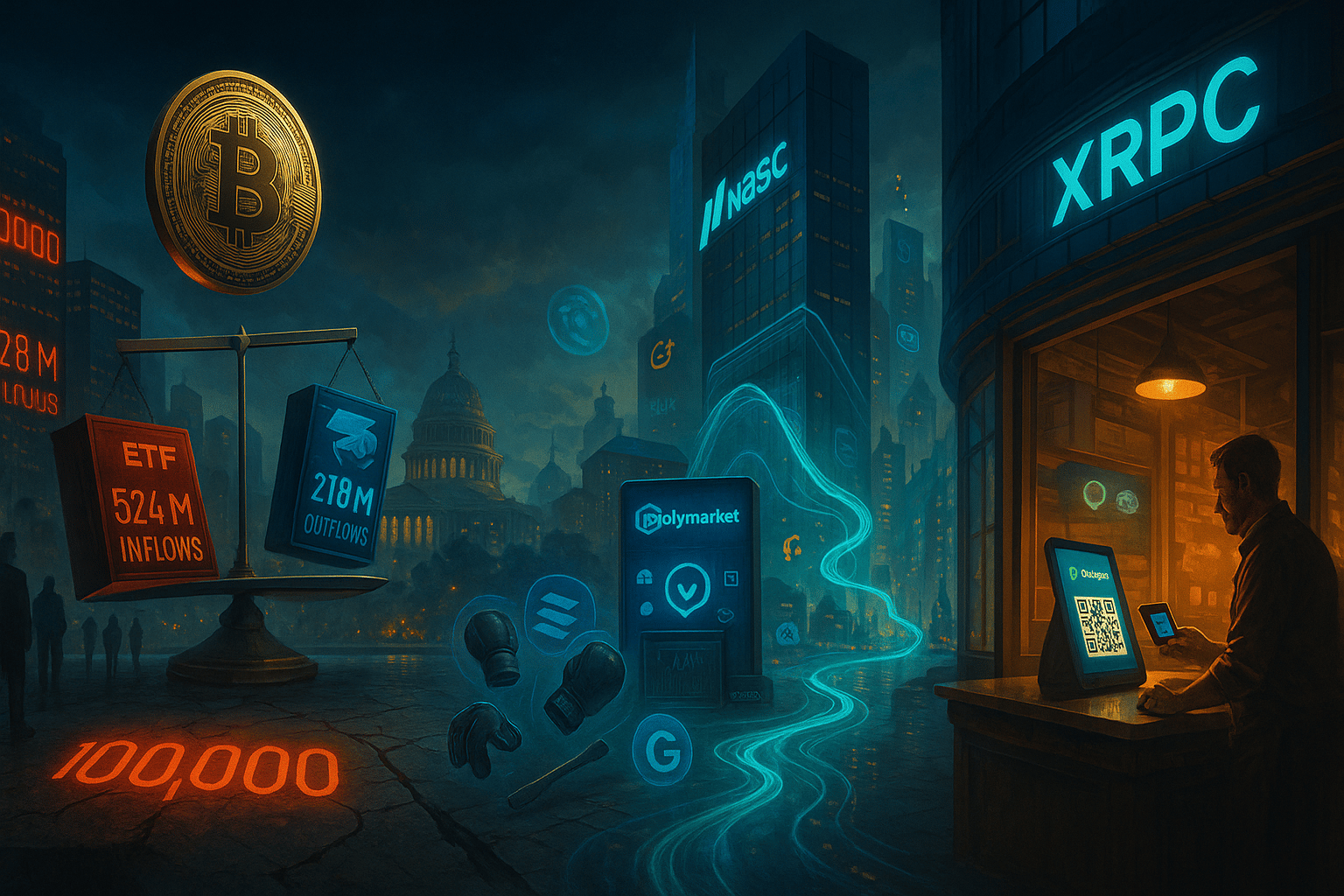

ETFs launch, prediction markets reopen, and macro pressure pushes BTC under 100K again.

Market Pulse: XRP’s ETF Era Begins as Bitcoin Slips Below 100K

Bitcoin fell back under the 100,000 level on Thursday, extending a pattern of weakness during U.S. trading hours as liquidity remains thin after the government shutdown. BTC dipped to roughly 98,500 before stabilizing, with analysts pointing out that whales accumulated more than 45,000 Bitcoin this week while leverage reset and derivatives positioning cooled.

Macro forces continue to dominate. Markets have priced out a December rate cut from the Federal Reserve, and the Nasdaq and S&P opened sharply lower. Crypto-linked equities were hit especially hard, with miners Bitdeer and Bitfarms falling more than 15 percent and broader crypto stocks sliding between 7 and 12 percent.

Despite the drawdown, JPMorgan maintains that Bitcoin’s production cost has risen to roughly 94,000, reinforcing a historically reliable price floor. Analysts continue to project a six to twelve month upside case near 170,000 once real yields stabilize.

From Our Partners

Investors Are Watching This Fast-Growing Tech Company

No, it's not Nvidia… It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Their disruptive tech has helped users earn and save $325M+, driving $75M+ in revenue and 50M+ consumer base. They’ve just been granted the stock ticker $MODE by the Nasdaq and over 56,000 investors participated in their previous rounds.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

Market Structure: XRP ETF Goes Live and Polymarket Reopens in the U.S.

Canary Capital launched the first standard-route U.S. spot XRP ETF on Nasdaq under the ticker XRPC, giving investors direct exposure through traditional brokerages. The fund cleared its backlog of regulatory steps through the SEC’s new generic listing standards, filing a Form 8-A earlier this week and securing Nasdaq approval.

Other issuers including Bitwise, WisdomTree, and Grayscale have similar XRP products pending. REX Shares previously listed a hybrid XRP fund through a non-standard structure, and filings point to Dogecoin ETFs potentially going effective as early as November 23.

Meanwhile, Polymarket has quietly reopened its U.S. trading platform in beta. The company, which settled with the CFTC in 2022, is rolling out regulated domestic access through its acquisition of QCX. Early users are able to trade live markets as the platform finalizes its nationwide return.

Polymarket also announced a multiyear exclusive partnership with TKO Group to integrate real-time prediction markets into UFC and Zuffa Boxing broadcasts. The deal adds to a growing list of integrations across Google, Yahoo Finance, PrizePicks, DraftKings, and the NHL.

Policy Front: Japan Tightens Oversight While Grayscale Files for NYSE IPO

Japan Exchange Group is weighing new oversight standards for listed companies with large crypto treasuries after several high-profile digital asset firms saw sharp drawdowns. Regulators are exploring stricter interpretations of reverse merger rules and may require fresh audits for companies pivoting into large-scale crypto accumulation.

The scrutiny has already prompted some firms to pause planned purchases, though Japan’s largest treasury holders have said they are not under investigation. Shares of Metaplanet, Convano, and Bitcoin Japan all fell sharply on the news.

In the U.S., Grayscale filed for an initial public offering on the NYSE under the ticker GRAY. The firm reported 35 billion in assets under management and highlighted a 365 billion addressable market for its product suite. The IPO joins a wave of crypto companies going public under the Trump administration, including Circle, Gemini, and Figure.

From Our Partners

Your Entire Portfolio is Dangerously Exposed…

Original Mag Seven turned $7,000 into $1.18 million.

But these seven AI stocks could do it in 6 years (not 20).

Now, the man who called Nvidia in 2005 is revealing details on all seven for FREE.

Chart Watch: Bitcoin Trades Heavy as Shutdown Effects Echo Through Markets

Bitcoin continued to show intraday weakness during U.S. sessions, breaking below 100,000 for the third time this month. Analysts noted a pattern of overnight strength in Asia followed by sell pressure during U.S. hours.

A strategist at Wincent said he expects the 2025 highs are already in for the year, with BTC likely to move sideways into the new year and resume a gradual climb thereafter. The near-term drag remains macro. With the shutdown temporarily driving a fiscal surplus for September and likely October, market liquidity dried up just as risk assets were searching for support.

Some analysts argue the trend will soon reverse. Fiscal data due later this month is expected to show a return to deficit levels, and the administration is preparing new spending measures heading into midterms. Any pickup in liquidity could help re-anchor price action around the 100,000 to 105,000 range.

Institutional Flow: ETF Tape Reveals the Market’s Inflation Anxiety

Bitcoin ETF flows showed sharp divergence this week. On November 11, U.S. spot funds took in 524 million, the strongest print in over two weeks. On November 12, they saw 278 million in outflows as desks pulled back ahead of long-bond supply and today’s CPI release.

The split reveals how tightly ETF flows track long-term Treasury yields. When borrowing costs eased on Tuesday, creations surged and the spread between ETF prices and NAV compressed. When supply concerns returned, redemptions followed.

Bitcoin stayed pinned near the 100,000 midpoint throughout, a sign that institutional positioning rather than sentiment drove the turn. Spot liquidity remained steady, derivatives stayed orderly, and most selling was flow-driven rather than structural.

The larger pattern reflects a market waiting for direction from inflation. A cooler CPI print could ease real yields and reopen ETF inflows. A hotter number would keep desks cautious and extend the tight-range trade around 100,000.

From Our Partners

The Altcoin ETF Wave Is Coming

Remember when Bitcoin ETFs were just a rumor — then $37 billion poured in and prices exploded?

Now it’s altcoins’ turn. Over 90 ETF applications are pending with the SEC, and analysts expect approvals for Solana, XRP, and Litecoin soon.

That’s why we created the “Crypto Bull Run Millionaire Blueprint” — showing how to find undervalued altcoins and profit from the next wave.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Adoption Watch: Cash App Adds Solana-Powered Stablecoin Transfers

Block expanded its payments reach again, announcing that Cash App will support stablecoin transfers in 2026 using Solana’s network as the initial settlement layer. The feature will allow users to send digital dollars globally within seconds, supporting multiple tokens and networks over time.

The move comes just days after Block enabled Bitcoin payments for four million Square merchants. Cash App will also add an option later this month for users to pay Lightning invoices with dollars while merchants receive Bitcoin, converting funds internally in one tap.

This combination of stablecoin rails and Bitcoin settlement positions Block as both an on-ramp and a liquidity engine for mainstream crypto payments, blending fiat familiarity with digital asset flexibility.

Investor Lens

This week drew a sharp line between stress and structure. Bitcoin softened as macro pressure built, yet whales accumulated. ETFs swung from heavy inflows to heavy outflows, yet the broader market held its range. XRP entered the ETF era. Polymarket returned to U.S. soil. Grayscale moved toward the NYSE.

Block kept tightening the bridge between Bitcoin and real-world payments.

The result is a market recalibrating rather than breaking. Crypto is absorbing rate anxiety and liquidity droughts while institutional rails expand beneath the surface. The volatility is real, but so is the scaffolding being built around it.

From ETFs to prediction markets to nationwide payments networks, the ecosystem is shifting from adolescence to architecture. The tape looks fragile, but the foundations look stronger each week.